The Asian aviation industry has long been recognized as one of the most dynamic and rapidly expanding sectors in the global market. However, in the aftermath of the pandemic, coupled with a range of economic challenges, regulatory changes, and geopolitical tensions, a critical question emerges as we look toward 2025: Is Asia’s aviation industry still struggling to recover from its unprecedented setbacks? The answer to this question is multifaceted. On one hand, there are clear signs of progress; airlines have ramped up flight schedules, passenger numbers are beginning to rebound, and new routes are being developed to meet increasing demand.

Additionally, investments in airport infrastructure and advancements in technology are paving the way for enhanced operational efficiency and customer experience. On the other hand, significant hurdles remain that threaten the industry’s full recovery. These include rising fuel prices, ongoing supply chain disruptions, and fluctuating travel restrictions in various countries. Furthermore, geopolitical tensions, such as trade disputes and regional conflicts, could impact travel patterns and airline profitability. In summary, while there are undeniable advancements in the Asian aviation sector, the road to complete recovery is still fraught with challenges that need to be addressed.

Mixed Recovery Across the Region

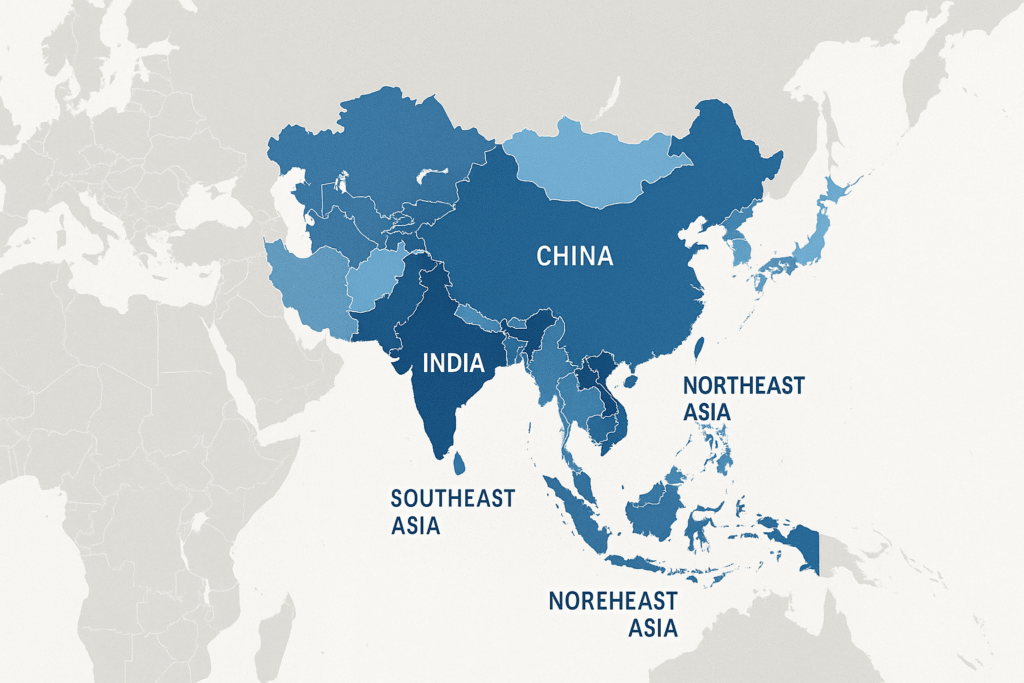

While regions in Asia, particularly China, India, and Southeast Asia, are seeing impressive growth in passenger traffic driven by increasing consumer demand and expanding middle classes, other areas especially smaller airlines and certain developing markets—are struggling with ongoing structural challenges. These challenges may include inadequate infrastructure, fluctuating economic conditions, and competition from larger airlines, which can hinder their ability to capitalize on the overall growth in air travel. As a result, while some markets flourish, others remain constrained by these persistent issues, highlighting a disparity in the aviation industry’s evolution across the continent.

According to the International Air Transport Association (IATA), passenger traffic across Asia-Pacific reached approximately 92% of pre-pandemic levels by mid-2025. However, recovery is uneven:

✔ China’s domestic market has rebounded rapidly, fueled by aggressive government support and rising middle-class demand.

✔ India continues to see robust growth, driven by budget airlines and infrastructure expansion.

✔ Southeast Asia lags slightly behind, with countries like Indonesia and Malaysia facing airline financial distress and operational challenges.

✔ Japan and South Korea are experiencing steady, but cautious international traffic recovery, influenced by currency fluctuations and fuel prices.

Key Struggles the Industry Still Faces

1. High Operating Costs

Rising fuel prices, fluctuating exchange rates, and increased maintenance expenses are squeezing profit margins, especially for low-cost carriers.

2. Pilot and Skilled Workforce Shortage

Despite the demand rebound, many Asian airlines report shortages of experienced pilots, engineers, and air traffic controllers, a result of pandemic layoffs and slow training pipeline recovery.

3. Regulatory and Infrastructure Bottlenecks

Limited airport capacity, outdated air traffic management systems, and bureaucratic hurdles continue to restrict growth in some regions.

4. Geopolitical Tensions

Ongoing tensions in the South China Sea, unpredictable visa regulations, and global trade uncertainties are adding risk factors to airline operations and route planning.

Bright Spots: Resilience and Innovation

Despite these struggles, Asia’s aviation sector shows remarkable resilience:

✔ Fleet Modernization: Airlines across Asia are investing in fuel-efficient aircraft like the Airbus A321XLR, COMAC C919, and Boeing 787, improving operational efficiency.

✔ Digital Transformation: Airlines are accelerating the adoption of AI-powered customer service, predictive maintenance, and contactless travel technologies.

✔ Emerging Markets: Countries such as Vietnam, the Philippines, and Bangladesh are seeing rising air travel demand, attracting new airline entrants and airport investments.

Expert Viewpoint

“The Asian aviation market is not in freefall, but it’s also not yet flying at full altitude,” says Dr. Samantha Wu, an aviation economist based in Singapore. “It’s a story of resilience, but also one of uneven recovery, where only the most adaptable carriers will thrive.”

A Region in Transition

As we look towards 2025, Asia’s aviation industry finds itself in a nuanced transitional phase. While not yet fully recovered from past disruptions, it is also not in a state of full decline. The current landscape presents a complex scenario in which airlines, regulatory bodies, and various stakeholders must adeptly navigate a variety of challenges, including economic volatility, infrastructure bottlenecks, and workforce shortages. Despite these hurdles, the potential for growth remains significant. Airlines are exploring innovative routes and service offerings, and there is a renewed focus on enhancing operational efficiency and passenger safety. However, achieving a sustained recovery will require strategic investments in technology and infrastructure, along with supportive policies that encourage collaboration among industry players.

Currently, the skies over Asia are seeing unprecedented activity, with flight volumes increasing as travel demand rebounds. Yet, even with this uptick, full stability is likely still a few flight cycles away as the industry works to address the ongoing challenges. MyAviation Magazine remains committed to tracking the evolving trajectory of Asia’s aviation sector and will provide in-depth insights into its dynamic development in the coming years. By staying informed, stakeholders can better prepare for the future and seize the opportunities that lie ahead.

Leave a Reply