The Malaysian aviation industry is in a phase of gradual recovery following the significant disruptions brought on by the COVID-19 pandemic. Although passenger traffic is slowly increasing, airlines continue to face various challenges, including financial pressures, escalating operational costs, and intense competition in the market. As we approach 2025, these factors are playing a crucial role in shaping airline revenues.

This article delves into the recent sales performance of major airlines operating within Malaysia, highlighting key players such as Malaysia Airlines, AirAsia, and Malindo Air. It examines the influences on their revenue streams, including consumer demand fluctuations, fuel prices, and regulatory changes impacting the sector. Additionally, the discussion encompasses the broader economic environment, travel trends, and innovations adopted by these airlines to enhance passenger experience and operational efficiency.

Furthermore, the article provides insights into the future growth prospects for the industry, considering both the challenges ahead and opportunities for expansion in a post-pandemic landscape. Whether through increased international flights, the introduction of new routes, or strategic partnerships, the outlook remains cautiously optimistic as the industry adapts to the evolving market dynamics.

1. Current Sales Revenue Landscape

Overview of Malaysian Airlines and the Aviation Industry in 2025

✅ Malaysia Airlines Berhad (MAB)

As the flag carrier of Malaysia, Malaysia Airlines Berhad (MAB) has demonstrated a moderate recovery in revenue during 2025, driven by a significant resurgence in international travel and the establishment of strategic partnerships.

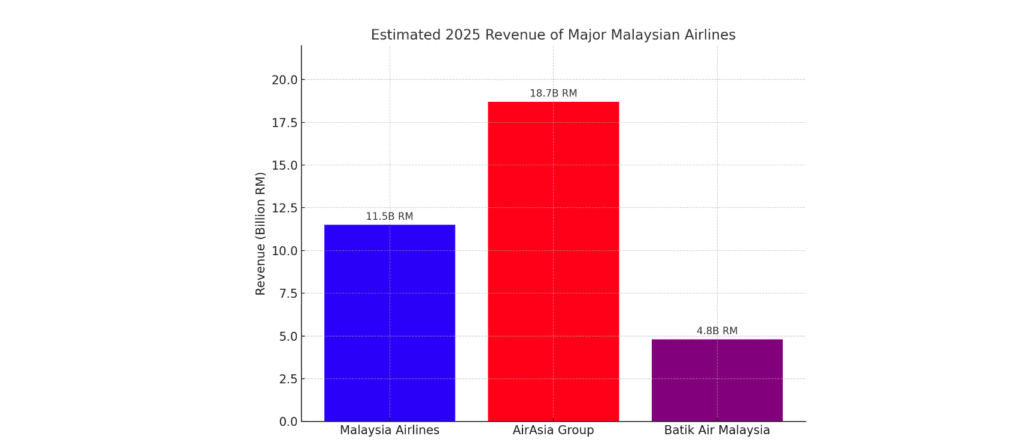

- Estimated Revenue for 2025: RM 11.5 billion

- Key Growth Drivers: The reinstatement of long-haul routes, which enhances connectivity to international markets; improved fleet utilization, allowing for more efficient operations; and a rebound in corporate travel as businesses resume face-to-face meetings and events worldwide.

- Challenges Faced: The airline grapples with a substantial debt burden that limits its financial flexibility, rising fuel prices that threaten to erode profit margins, and intense competition from low-cost carriers that often offer lower fares.

✅ AirAsia Group

AirAsia remains the dominant player in the low-cost airline sector across the region, capitalizing on robust demand for both domestic routes and short-haul international travel, which significantly bolsters its financial results.

- Estimated Revenue for 2025: RM 18.7 billion

- Key Growth Drivers: High passenger numbers on popular routes, aggressive pricing strategies that attract budget-conscious travelers, and rapid expansion into new markets within the ASEAN region, enabling greater access to underserved locations.

- Challenges Encountered: The airline must navigate operational cost pressures stemming from increased expenses, currency fluctuations impacting profitability, and fierce fare wars that put downward pressure on ticket prices.

✅ Batik Air Malaysia (formerly known as Malindo Air)

Batik Air Malaysia is effectively establishing its brand as a hybrid carrier, which marries low-cost options with select full-service amenities to cater to a diverse range of travelers.

- Estimated Revenue for 2025: RM 4.8 billion

- Key Growth Drivers: Competitive regional routes that attract leisure and business travelers; code-sharing agreements with other airlines that broaden their network reach; and moderate pricing strategies designed to appeal to both budget and middle-market customers.

- Challenges Experienced: The airline faces limited brand recognition in comparison to its more established rivals, AirAsia and Malaysia Airlines, which can hinder its market penetration efforts.

2. Drivers of Revenue Growth in 2025

✈️ Post-Pandemic Travel Demand

The travel and tourism sectors in Malaysia are witnessing a strong recovery as pent-up demand for travel after the pandemic fuels an increase in passenger bookings, particularly on routes connecting Malaysia to major markets like China, India, and key cities within ASEAN.

✈️ Rising Passenger Load Factors

Airline load factors—the percentage of available seats that are filled—have rebounded to an encouraging average of 80-85% across major carriers in 2025, resulting in significant improvements in revenue per available seat kilometer (RASK), a key indicator of operational efficiency.

✈️ Increased Ancillary Revenue

Airlines are strategically enhancing their revenue streams through ancillary services such as baggage fees, priority boarding, in-flight purchasing options, and travel insurance offerings—these additional sales can represent as much as 25-30% of overall revenue for low-cost carriers.

✈️ Cargo Revenue Expansion

Cargo operations, particularly the transport of goods within the belly holds of passenger flights, continue to provide reliable revenue streams, even as overall volumes have begun to stabilize following the pandemic’s peak disruption.

3. Key Challenges to Revenue

- Volatile Jet Fuel Prices: Fuel expenses account for roughly 30-40% of operating costs for airlines, making them particularly vulnerable to fluctuations in global oil prices, which can drastically impact profit margins.

- Overcapacity Risks: The combination of aggressive pricing strategies among competitors and an excess number of available seats on certain domestic and regional routes may lead to suppressed revenue yields.

- Currency Pressure: With revenue streams denominated in multiple currencies, Malaysian airlines face exposure to foreign exchange risks that can complicate financial forecasting and stability.

- Shifting Consumer Behavior: Price-sensitive travelers are influencing market dynamics, pushing airlines to maintain competitive fare structures that limit their ability to elevate ticket prices for increased profits.

4. Future Outlook: Growth with Caution

Analysts predict that the Malaysian airline industry will maintain an annual revenue growth rate of between 4-6% CAGR (Compound Annual Growth Rate) over the next three years, provided there are no major global economic disruptions.

Growth Opportunities:

✔️ Expansion into New Routes: The exploration of new service routes to secondary cities in China and India offers substantial potential for growth and increased passenger traffic.

✔️ Investment in Fleet Modernization: Upgrading aircraft to incorporate the latest fuel-efficient models will not only reduce operational costs but also align with sustainability goals.

✔️ Maximizing Digital Sales Channels: Enhancing digital platforms and monetizing loyalty programs could create new revenue opportunities and improve customer retention rates.

✔️ Support from Government Initiatives: Potential government backing for national carriers could bolster their financial stability and encourage deployment of resources aimed at enhancing service quality.

Competitive Yet Resilient Sector

In 2025, the Malaysian airline industry showcases a fiercely competitive landscape that also exhibits resilience, spurred by an upsurge in passenger demand and innovative market strategies. AirAsia continues to lead in terms of passenger volume and regional network distribution, while Malaysia Airlines focuses on premium service offerings and leveraging global partnerships to bolster its revenue base. Achieving sustainable revenue growth will hinge on the airlines’ abilities to enact strategic pricing, enhance operational efficiency, and continually invest in the customer experience to foster long-term loyalty in a rapidly evolving marketplace.

Here is a financial chart showing the estimated 2025 revenue for major Malaysian airlines.

.

.

Leave a Reply